Startup companies in the us

Editor’s note: Aileen Lee is founder of Cowboy Ventures, a seed-stage fund that backs entrepreneurs reinventing work and personal life through software. Previously, she joined Kleiner Perkins Caufield & Byers in 1999 and was also founding CEO of digital media company RMG Networks, backed by KPCB. Follow her on Twitter @aileenlee.

Editor’s note: Aileen Lee is founder of Cowboy Ventures, a seed-stage fund that backs entrepreneurs reinventing work and personal life through software. Previously, she joined Kleiner Perkins Caufield & Byers in 1999 and was also founding CEO of digital media company RMG Networks, backed by KPCB. Follow her on Twitter @aileenlee.

Many entrepreneurs, and the venture investors who back them, seek to build billion-dollar companies.

Why do investors seem to care about “billion dollar exits”? Historically, top venture funds have driven returns from their ownership in just a few companies in a given fund of many companies. Plus, traditional venture funds have grown in size, requiring larger “exits” to deliver acceptable returns. For example – to return just the initial capital of a 0 million venture fund, that might mean needing to own 20 percent of two different $1 billion companies, or 20 percent of a $2 billion company when the company is acquired or goes public.

For example – to return just the initial capital of a 0 million venture fund, that might mean needing to own 20 percent of two different $1 billion companies, or 20 percent of a $2 billion company when the company is acquired or goes public.

So, we wondered, as we’re a year into our new fund (which doesn’t need to back billion-dollar companies to succeed, but hey, we like to learn): how likely is it for a startup to achieve a billion-dollar valuation? Is there anything we can learn from the mega hits of the past decade, like Facebook, LinkedIn and Workday?

To answer these questions, the Cowboy Ventures team built a dataset of U.S.-based tech companies started since January 2003 and most recently valued at $1 billion by private or public markets. We call it our “Learning Project, ” and it’s ongoing.

With big caveats that 1) our data is based on publicly available sources, such as CrunchBase, LinkedIn, and Wikipedia, and 2) it is based on a snapshot in time, which has definite limitations, here is a summary of what we’ve learned, with more explanation following this list*:

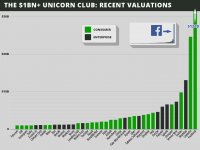

Learnings to date about the “Unicorn Club”:

- We found 39 companies belong to what we call the “Unicorn Club” (by our definition, U.S.-based software companies started since 2003 and valued at over $1 billion by public or private market investors). That’s about .07 percent of venture-backed consumer and enterprise software startups.

You might also like

Nortech Systems' (NSYS) CEO Rich Wasielewski on Q2 2014 Results - Earnings .. — Seeking Alpha

This expertise is especially valuable for development stage and start-up medical device companies. These companies are looking to us as manufacturing partners, so they can better focus on research and development and marketing of their products.

|

THE ENTREPRENEURIAL BIBLE TO VENTURE CAPITAL: Inside Secrets from the Leaders in the Startup Game Book (McGraw-Hill)

|