Insurance company startups

Health insurance under the Affordable Care Act is finally here. But there is good news! SimplyInsured’s guide to 2014 could save your startup 30-85% on your health care costs.

Health insurance under the Affordable Care Act is finally here. But there is good news! SimplyInsured’s guide to 2014 could save your startup 30-85% on your health care costs.

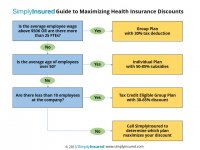

Our Advice:

- If your company’s average employee salary is over $50K OR employ more than 25 FTEs – Purchase a group plan here www.simplyinsured.com

- If your company’s average employee age is over 50 – Purchase a subsidized individual plan by calling SimplyInsured (888.584.9220)

- If your company has fewer than 10 employees – Purchase a tax-credit eligible group plan from www.simplyinsured.com

- All other companies – Call SimplyInsured (888.584.9220) to help navigate your options

Analyzing Tax-Credits and Subsidies: Potential 30-85% Discount on Health Insurance

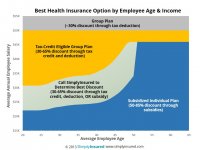

SimplyInsured’s analysis of health insurance 2014 shows selecting the appropriate plan could reduce health insurance premiums by 30-85%. The following chart show the appropriate plan decision based on average age and salary of your employees:

Conclusions on maximizing discounts:

- Businesses with average salaries over K/year or more than 25 employees should purchase a group plan - to achieve a 30% tax deduction

- Businesses with employees over 50 should purchase subsidized individual plans – to achieve a 50-85% discount for employees over 50

- Businesses with employees under 40 and average salaries over K/year should purchase a tax credit eligible group plan - to achieve a 30-65% discount through tax credits and deductions

The What Are the Health Insurance Plans and Discounts Available to My Startup?

As a reference guide, startups can choose from three types of health insurance plans:

1. Group Health Insurance Plan

- Discounts: Premiums paid by the company are tax deductible, saving most companies 30-35% (depending on tax rate)

- Eligibility: Any small business with 2 or more employees are eligible

- Key Benefits: Wide selection of carriers and plan types

2. Tax Credit-Eligible Group Health Insurance Plan

- Discounts: Companies can get up to 50% in tax credit for the premium paid as well as a tax deduction

- Eligibility: Businesses with fewer than 25 FTEs and average annual salaries under $50K are eligible

- Key Benefits: Employees can choose from between different carriers and coverage levels

You might also like

Technori Pitch: 8 principles for innovation in a corporate ecosystem — Chicago Tribune

Technori Pitch is a monthly event in which Chicago startup companies pitch their latest technologies and products in front of entrepreneurs and investors.

|

Insurance Premium Finance Company Business Plan, Marketing Plan, How to Guide, and Funding Directory Single Detail Page Misc (BizStartupDB)

|