New York Startup tax free

The corporate real estate veteran picked to lead a groundbreaking state program says START-UP NY will do exactly that for the state’s economy.

The corporate real estate veteran picked to lead a groundbreaking state program says START-UP NY will do exactly that for the state’s economy.

An important provision of the STARTUP-NY program is that “businesses that might compete unfairly with other local businesses outside the tax-free area would be ineligible to participate.” Here are some of the program’s other parameters, as it begins to ramp up for a January 1, 2014, start:

- Tax-Free: In addition to the lack of taxes on businesses, employees in participating companies will pay no income taxes for the first five years. For the second five years, employees will pay no taxes on income up to $200, 000 of wages for individuals, $250, 000 for a head of household, and $300, 000 for taxpayers filing a joint return. The number of net new jobs eligible for personal income tax benefits will not exceed 10, 000 new jobs per year.

- Eligibility: In order to locate into a START-UP NY tax-free community, a business needs to be aligned with or further the academic mission of the sponsoring campus, college or university. Every business must create and maintain net new jobs in order to participate.

Businesses must be a new start-up company; a company from out-of-state that is relocating to New York State; or an expansion of an existing New York company — as long as it can demonstrate that it is creating new jobs and not moving existing jobs.

Businesses must be a new start-up company; a company from out-of-state that is relocating to New York State; or an expansion of an existing New York company — as long as it can demonstrate that it is creating new jobs and not moving existing jobs.

Start-ups from New York State incubators will be eligible to enter tax-free communities and be eligible for the benefits under the program. In New York City, Long Island and Westchester County, businesses must be start-ups or high-tech companies. Statewide, certain types of businesses are excluded from the program, including retail and wholesale businesses; restaurants and hospitality; professional practices like law firms and medical practices; and energy production and distribution companies.

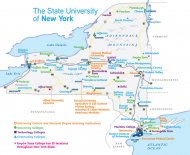

Every SUNY community college and four-year college/university can establish a tax-free community using vacant land or vacant building space on campus (for those outside New York City); any business incubator with a bona fide affiliation to the campus, university or college; and up to 200, 000 sq. ft. (18, 580 sq. m.) within one mile of a campus (for every campus north or west of Westchester County), or further with approval from Empire State Development (ESD). The City University of New York (CUNY) will be able to establish a tax-free community on a campus in each borough — Manhattan, the Bronx, Queens, Brooklyn and Staten Island — in an area of economic distress.

“As the corporate real estate person, I’d be looking at the numbers.”

— Leslie Whatley, executive vice president, START-UP NYYou might also like

|

Start-Up At The New Met: The Metropolitan Opera Broadcasts 1966-1976 Book (Amadeus Press)

|

Patient care tech VerbalCare wins $15k in Fenway Fast Pitch — Boston Business Journal

Boston startup Verbal Applications, maker of a patient engagement software called VerbalCare, took home $15,000 in a competition at Fenway Park on Thursday that pitted three Boston startups against three New York City startups.