Healthcare Internet startups

Every month we compile all of the deals at Washington tech and biotech companies into one story where we watch up and coming trends in local financing. Unlike our regular investment coverage and weekly deals roundups, these monthly features give us a chance to look at both the large investments that usually make news, alongside smaller “under the radar” deals we may not have yet reported on. The information is based on data provided by our partner, New York-based private company intelligence platform, and our own prior coverage.

Every month we compile all of the deals at Washington tech and biotech companies into one story where we watch up and coming trends in local financing. Unlike our regular investment coverage and weekly deals roundups, these monthly features give us a chance to look at both the large investments that usually make news, alongside smaller “under the radar” deals we may not have yet reported on. The information is based on data provided by our partner, New York-based private company intelligence platform, and our own prior coverage.

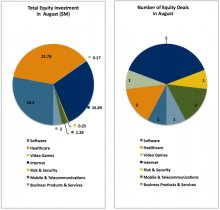

This data gives us an in-depth look at which sectors are leading in financing month to month, which continually ink the most (or fewest deals), which are gathering equity versus debt funding, and what trends can be seen over time. Over the last two months, healthcare has been the clear leader. But after July’s lull in funding in every other sector, August’s numbers indicate a significant rise in financing in both the software and Internet industries as well, a promising notion given that the two sectors have brought in modest amounts of financing over the last few months.

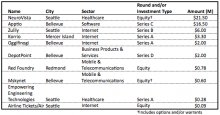

Of the 13 deals Washington companies saw in August, only two were in healthcare, though they were sizable, accounting for $21.8 million of the $59 million total investment across all sectors. August, no surprise, was a slower month than usual for healthcare financing, given that the sector raised $62.5 million in July and $41.1 million in June, according to previous reports based on CB Insights data. The Internet sector, at $16.9 million, and software, with $16.5 million, came close to raising as much as healthcare in August. The business products and services sector took a distant fourth place, with $2 million in financing in August, while mobile and telecommunications companies came in fifth with $1.4 million. The only other two sectors to earn financing in August—video games, and risk and security—brought in less than $1 million each.

Of the 13 deals Washington companies saw in August, only two were in healthcare, though they were sizable, accounting for $21.8 million of the $59 million total investment across all sectors. August, no surprise, was a slower month than usual for healthcare financing, given that the sector raised $62.5 million in July and $41.1 million in June, according to previous reports based on CB Insights data. The Internet sector, at $16.9 million, and software, with $16.5 million, came close to raising as much as healthcare in August. The business products and services sector took a distant fourth place, with $2 million in financing in August, while mobile and telecommunications companies came in fifth with $1.4 million. The only other two sectors to earn financing in August—video games, and risk and security—brought in less than $1 million each.

You might also like

How Your Taxes Pay for Hipsters to Doss About Making iPhone Apps — Breitbart News

Venture capital is an immensely risky asset class.